The Fintech revolution is in full swing, and AI in Fintech is playing a pivotal role in accelerating innovation. Financial institutions and startups alike are capitalizing on the capabilities of AI to deliver personalized products, automate manual processes, and mitigate risks.

As AI transforms the Fintech ecosystem…

…it holds the promise of unlocking a brighter future for finance.

By analyzing massive datasets and recognizing patterns which are too complex for humans, AI algorithms can provide real-time insights and predictive analytics. Sounds amazing?

AI in the Fintech industry allows companies to understand customers more deeply, tailor offerings to their needs, and manage risks more effectively. From robo-advisors to Chatbots, AI-powered solutions are making financial services more inclusive and accessible. It is clear that AI is transforming the DNA of Fintech, opening up new possibilities.

As AI becomes more intelligent, it will propel the Fintech sector into an era of hyper-efficiency and hyper-personalization. You must be wondering… how is this going to happen? Don’t worry this blog post will explore the far-reaching impact of AI in fintech.

Table of Contents

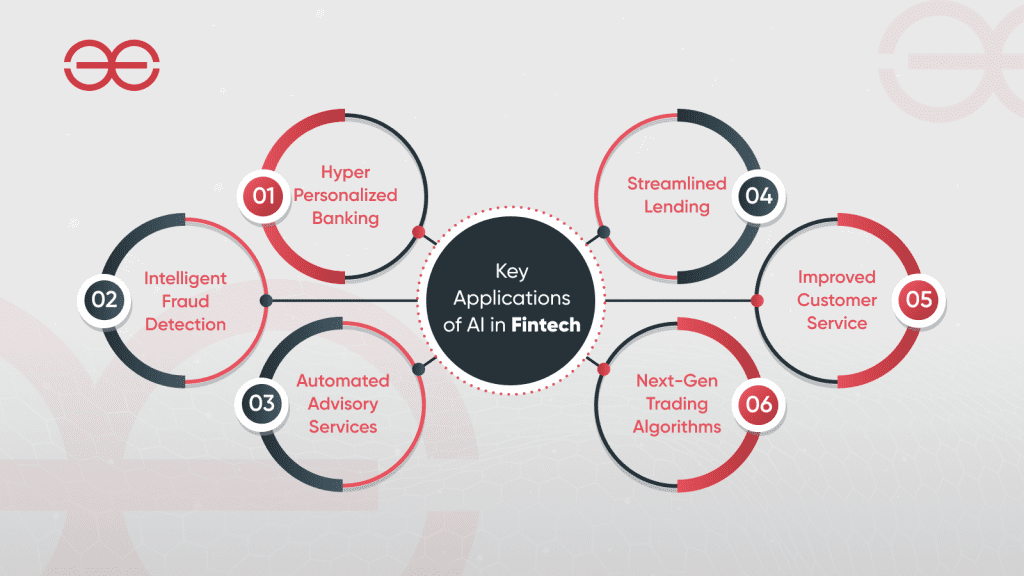

ToggleKey Applications of AI in Fintech

The future of AI in Fintech has never looked more promising… it is being deployed across the fintech ecosystem to reshape products, services, and operations.

Here are some of the key applications:

- Hyper Personalized Banking

Using techniques like natural language processing, machine learning, and sentiment analysis, AI applications can understand customer behaviors, analyze financial transactions, and discern consumer preferences – that too with perfection.

Based on these insights, banks can provide tailored product recommendations, notify customers about relevant offers, and deliver a hyper-personalized banking experience.

Chatbots act as virtual financial assistants, providing customized guidance and advice. Spanish bank BBVA’s AI-driven chatbot can understand complex customer requests while handling over 80% of customer inquiries without human intervention.

- Intelligent Fraud Detection

If we talk about the highly advanced pattern recognition capabilities of deep learning algorithms – it can identify fraudulent activities much faster and more accurately than humans. By continuously learning from huge volumes of customer data, purchase history, transactions, and network connections, AI systems can build fraud prevention models to detect suspicious behavior and prevent cybercrimes.

According to McKinsey, AI-based fraud prevention solutions can deliver over 50% improvement in fraud detection compared to traditional rules-based systems. Fintech Company Feedzai uses AI to screen 1 billion transactions per hour for fraud risk.

- Automated Advisory Services

Robo-advisors powered by AI provide automated investment portfolio management, rebalancing, and retirement planning guidance without human intervention. Now you see, how AI in Fintech is doing wonders… The algorithms assess a customer’s financial situation, risk appetite, and investment objectives to create and manage customized portfolios of ETFs and index funds.

Leading robo-advisors such as Betterment and Wealthfront are using AI to deliver quality financial advice and portfolio management at lower costs compared to traditional wealth managers. This expands access to advisory services.

- Streamlined Lending

By automating the loan underwriting process, AI allows for faster lending decisions and higher loan volumes. The algorithms can review thousands of data points from papers, applications, and transactions – in minutes to determine creditworthiness. This enables financial firms to handle loans faster.

Upstart uses over 1,000 variables and machine learning techniques to underwrite consumer loans more accurately than traditional FICO score-based lending models. This has helped them reduce their loan default rate.

- Improved Customer Service

Chatbots act as virtual assistants for answering common customer queries while enabling human agents to focus on complex issues. AI in the Fintech industry has introduced sentiment analysis tools, it can detect the mood and temperament of customers from their calls and texts to identify dissatisfied customers. Keep in mind that such tools enhance customer experiences and satisfaction.

- Next-Gen Trading Algorithms

AI in Fintech has made revolutionary developments – the algorithms can analyze massive amounts of market data, news, social media sentiments, and indicators to make trading decisions in milliseconds. This enables developers to construct intelligent stock trading systems that can respond to changing market conditions.

Quant hedge funds are already using AI and deep learning to build next-gen stock trading algorithms that can outperform human fund managers. As AI models continue to become more sophisticated, they’ve the potential to transform how trading is done.

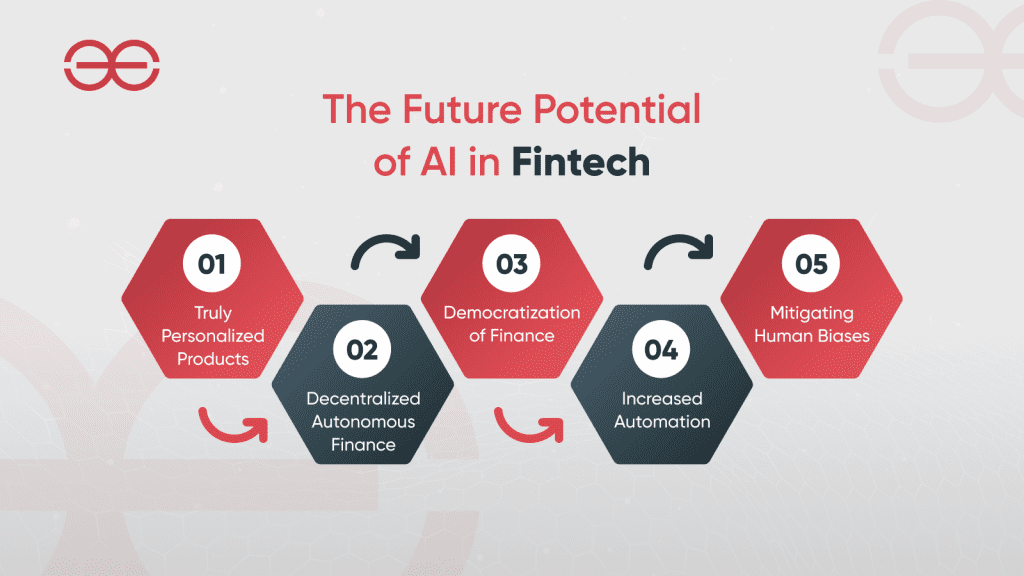

The Future Potential of AI in Fintech

Currently, AI applications in Fintech are focused on enhancing existing products and processes. But as AI research continues to push the boundaries of what is possible, more transformative applications could emerge:

- Truly Personalized Products

In the future, AI agents could engage directly with consumers as financial advisors, understand their desires and preferences, and design completely tailored products on the fly to match individual needs. Surprisingly, it could enable a whole new level of personalization.

- Decentralized Autonomous Finance

AI-driven decentralized finance (DeFi) applications could enable digital, peer-to-peer financial services on blockchain networks beyond centralized control. Smart contracts powered by AI could revolutionize lending, trading, insurance, and more – yes, you read that right!

- Democratization of Finance

On the other hand, sophisticated robo-advisor technology could become widely accessible to the masses, helping democratize professional financial and investment management. Millions of unbanked individuals could also gain affordable access to financial services.

- Increased Automation

More manual, repetitive finance tasks could be handed over to AI in Fintech. This would allow the financial workforce to focus on creative, strategic roles as AI would take over mundane work.

- Mitigating Human Biases

AI systems are trained responsibly on diverse. Hence, its unbiased data sets can help reduce long-standing human biases in financial services, like racial or gender discrimination in lending. This would surely create more inclusion.

Challenges of Deploying AI in Fintech

While the potential is exciting, effectively leveraging AI in fintech also comes with some notable challenges:

- Building robust data pipelines and maintaining data quality is essential for accurate AI systems. Issues with biased or incomplete data can exacerbate problems.

- Lack of explainability and audit trails for AI model decisions emergent behaviors remains a concern. Mechanisms to ensure models act ethically are needed.

- AI models require continuous monitoring, retraining, and evaluation. Model risk management is critical.

- As fintech AI systems become more complex, security vulnerabilities may arise that cybercriminals could exploit.

- AI could lead to the inadvertent exclusion of demographics who lack digital data footprints for training algorithms. Mindfulness is required.

- Job losses due to automation may necessitate retraining programs for the fintech workforce to transition into new roles.

The Road Ahead

AI in Fintech is undoubtedly going to be a defining force propelling fintech innovation into the future. It can dramatically improve how financial institutions operate and serve customers. However, AI also brings risks, like exacerbating biases and job losses.

Managing these downsides while maximizing the upsides of AI will require foresight and responsibility. But if harnessed ethically, AI could expand access to affordable, high-quality financial services, democratize financial management, and help create a more just and inclusive finance ecosystem. The possibilities for using AI to improve lives are immense.

Overall, AI will shape the fintech revolution in ways we can only begin to imagine today. The future looks exciting as fintech leverages the transformative power of AI to build a better financial world.

For more information: contact Geeks of Kolachi.